VA Insurance Co Settles Class Action Lawsuit For $40 Million

Prudential Insurance Co, the primary VA Insurance Co for underwriting life insurance for veterans and serivcemembers, just settled a huge class action lawsuit for $40 million. The suit was between Prudential and family members of some 67,000 fallen veterans who were stiffed death benefits.

Is $40 million really enough when the company ripped off so many families? The settlement seems like more of a slap in the face in light of the huge profit the company likely earned on the backs of dead vets.

Prudential is the insurance company with a 60-year monopoly on underwriting life insurance policies for veterans and servicemembers. Apparently, Prudential executives decided the company had not earned enough during its 60-year monopoly such that it decided to screw families of dead servicemembers to really squeeze out an extra few million.

Why does VA not underwrite its own life insurance policies? Instead, it relies on a private company to rip off veterans’ families as if they are not already disadvantaged enough.

The main argument of the lawsuit was that Prudential mistreated beneficiaries by screwing these family members with low interest rats and holding back lump sum payouts. Here is what this means. According to the suit, Prudential bullied family members into taking low monthly payments while it, Prudential, earned more money on investments of the funds it was supposed to pay out in a lump sum.

Beyond this:

In addition, beneficiaries typically did not receive checks for cash but “draft checks” that were subject to negotiation among retailers and financial entities, plaintiffs’ lawyers said during court hearings. The debate focused on the use of “Alliance Accounts,” akin to checking accounts, that come with a booklet of drafts. The policy allows families to write a check for the full amount of the payment or in 36 monthly installments.

Sadly, the settlement means plaintiff’s will only receive $125 each while the law firm earned $9.7 million. And really, $40 million is likely a pittance in comparison to the profit they earned while screwing veterans’ families out of the money they deserved.

Does the harm from unethical administration of benefits not fall squarely on VA’s shoulders for failing to ensure veterans’ families are treated fairly? What was your experience with Prudential lowballing your payout?

Read More: https://www.masslive.com/news/index.ssf/2014/12/prudential_ordered_by_federal.html

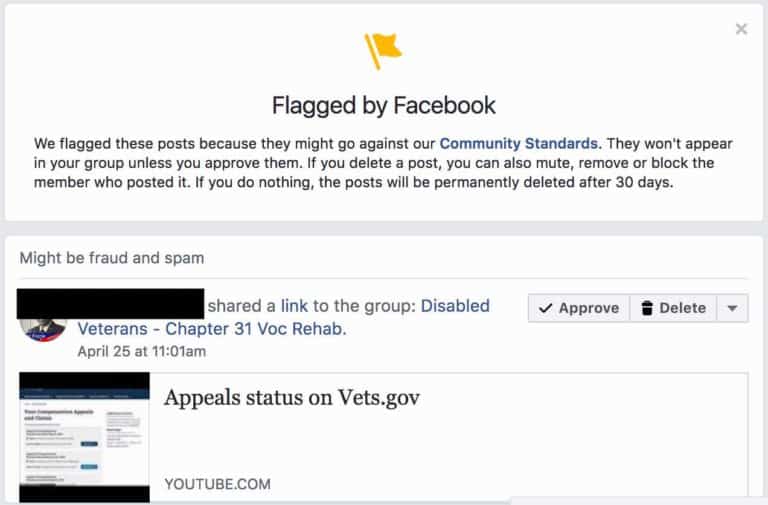

Can Vets now sue the VBA for failure to properly insure that the “contract” was properly administered and failure to comply with the law “as written”? Pawning it off on the insurer and insured seems to fail on all legal and moral fronts.

UNFORTUNATELY, I worked at the ROCK in the late 70s. I did not think that as a Debit Agent it was very prudent for me to earn a living on the backs of people who were barely EEKING out a living.

Sad as it may seem, I did for 2 years. I found a better job, making more $$$$$, earning on MY OWN BACK. When you think of BUSINESS relations, “remember one word PROFIT”, and that there are no “NON-PROFIT” BUSINESSES. They may GIVE AWAY millions, but that only means they are COLLECTING billions, or maybe even trillions in PROFITS.

This again shows how broken the VA system is. We veterans have been made (drafted) to serve, volunteered to serve, and have resigned many times to serve this country. The whole time we knew the actions of signing the paper and as a result, some have paid the ultimate price. The result, the VA is more concerned with making money from us veterans, denying us the benefits we are entitled to receive, and covering their own a** that actually upholding their end of the deal is on the bottom of the list. Do we mean so little to them that it has come to a settlement of my fellow vets who gave their lives are worth $125 each. We mean that little to the VA. That makes me feel so much better about the VA. (yes I am being sarcastic)

They (the VA and the govt.) and all their cohorts run a tight ship and stick together no matter what. this was evident with the Phoenix VA scandal in witch the OIG found nothing to show that the VA did anything wrong. Yet VA whistleblowers who were fired because of their concern of the VA’s wrongdoing received a monetary settlement because of they were wrongly fired. How can they be wrongly fired if they were concerned that veterans were not getting the proper treatment and the OIG states nothing was found? It sounds as if it is a catch 22 for them. They can’t complain due to the risk of being fired and they are not happy working for the VA. Now this from the VA. It makes me feel so good that now I know the VA and the govt. thinks that my life and my service to this country means so little to them.

I have no intention for trying to leave a good comment to Ben, after the wonderful one you wrote. You’ve said it all. Thank you so much!

Thank you Julia and thank you for your service. This came to me as I started writing and it seemed to fit so I went with it.

Thanks again

Frigin Baahstrdly Mother Fletching Company Scrooges